understanding your employer's investment options

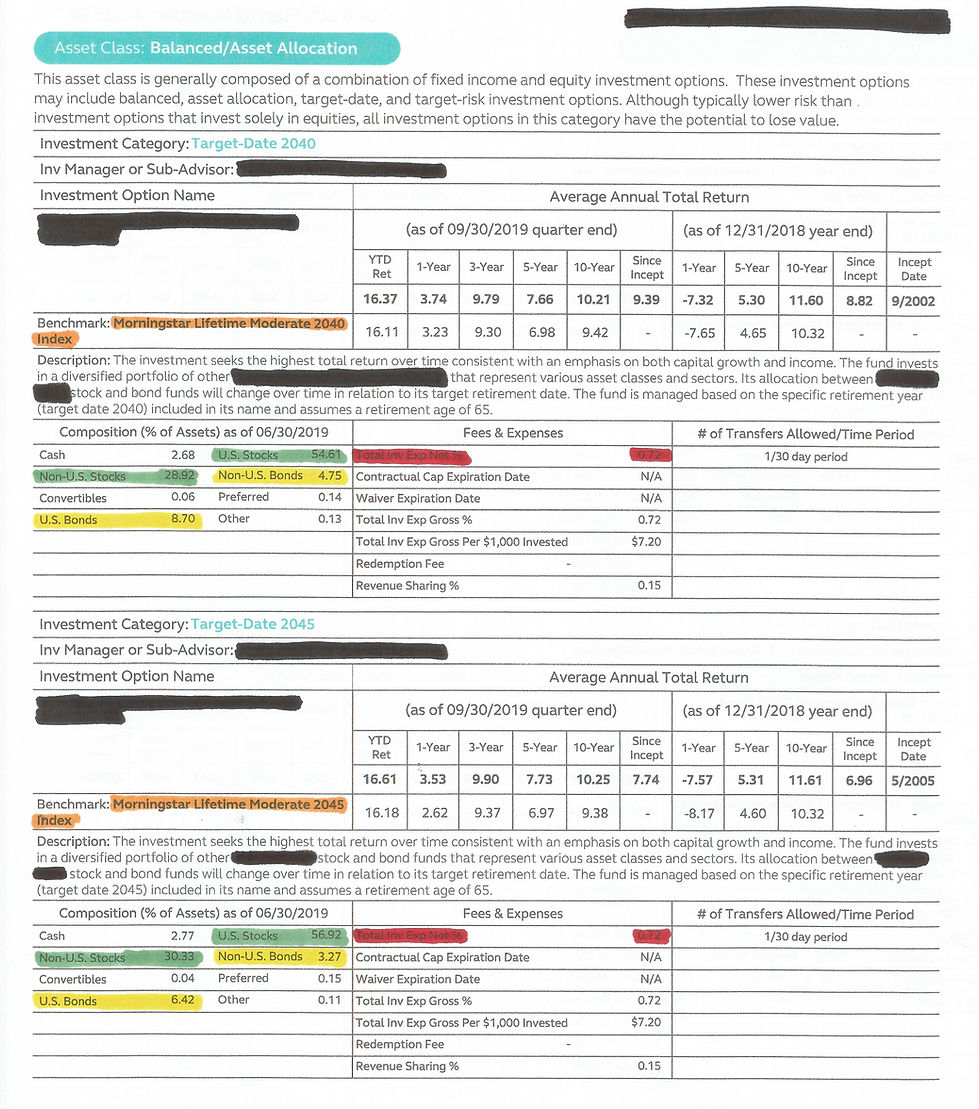

If your employer offers a 401k, 403b, or some similar pre-tax retirement account, you will likely receive an annual retirement plan communication from them that reviews the available investment options. These documents can be long and somewhat confusing, so I scanned 3 examples below and sought to simplify them for you. In each example, I have highlighted the following items: the fund's benchmark (orange), the fund's expense ratio (red), the percentage of bonds in the fund (yellow), and the percentage of stocks in the fund (green).

A fund seeks to replicate the investment returns of its benchmark. For example, in the two 'Large U.S. Equity' funds in the second example, their benchmark is listed as the Russell 1000 Index. Think of the Russell 1000 Index as a list of the top 1,000 U.S. companies by market value. If those 1,000 companies have a positive return, so should the fund which uses it as its benchmark.

Nothing is free in the investing world, and retirement accounts are no different. The fund's expense ratio is the cost of doing business. It is listed as a decimal, but think of it as a percentage. For example, an expense ratio of 1.00 means that the investor owes 1% of the account's balance to the investment manager each year. Competition in the investment arena has driven down expense ratios to 0.05% and lower.

You will likely find that many investment funds are made up of simply two things: stocks and bonds. When an investor buys a bond, he or she is buying the debt of a company or government entity. In return, the investor expects to receive back the full amount of the bond, plus interest, over a period of time. When an investor buys a stock, he or she is buying a share of the company. If the value of that company increases, so too does the value of the shareholder's stock purchase. Stocks are considered to be more volatile than bonds.

(Keep in mind that I did not highlight any information in the 'Average Annual Total Return' sections. Most experts agree that historical returns do not guarantee future returns.)

The first example lists two investment options in the 'Fixed Income' asset class. This asset class primarily invests in bonds. As you can see below, over 95% of both of these funds is invested in bonds. While both of the funds below are similarly invested in bonds, they do have quite different expense ratios. The first fund has an expense ratio of almost 1%, while the second has a minuscule 0.03% expense ratio.

The second example below lists two investment options in the 'Large U.S. Equity' asset class. This asset class primarily invests in stocks. As you can see below, both of these funds are comprised of over 99% stocks. They also have relatively low expense ratios, at 0.02% and 0.12%, respectively.

The third and final example below focuses on two investment options within the 'Balanced' asset class. These types of funds are typically referred to as 'Target Date Funds'. Why? Because they target a specific date for your retirement. Why are they referred to as 'Balanced'? Because they contain a mixture of stocks and bonds.

How do they work? Let's use an example.

Let's say you are 45 years old and plan to retire at age 65. Most financial advisors would agree that you could invest aggressively at this point because you don't need the money for 20+ years. (Aggressive investing would mean having a higher percentage of your nest egg in stocks compared to bonds.) You could do the math and balance your retirement accounts yourself, or you could simply invest all of your monies in a 'Target Date Fund' and be done with it all. As you get older, the 'Target Date Fund' rebalances your portfolio for you, taking on less risk (i.e. increasing the percentage of bonds) as you approach your retirement age. The 'Target-Date 2045' example below is comprised of 87% stocks and roughly 10% bonds, with the remainder in cash. Its expense ratio of 0.72% isn't fantastic, but it may be worth it for the investor who doesn't have the time or desire to rebalance their portfolio each year.

Questions? Comments? Email us!